WHAT IS EARNEST MONEY

-

15 March, 2024

-

8:04 pm

When you find a home and enter into a purchase contract, the seller may withdraw the house from the market. Earnest money, or good faith deposit, is a sum of money you put down to demonstrate your seriousness about buying a home.

In most cases, earnest money acts as a deposit on the property you’re looking to buy. You deliver the amount when signing the purchase agreement or the sales contract. It can also be part of the offer. The seller and buyer sign a contract that defines the conditions of refunding earnest money.

Importance of earnest money

- In most cases sellers will ask for a good faith deposit. It safeguards the interests of the seller and the buyer. It shows the seller you’re serious about buying the home, which can be reassuring to them if they agree to take the house off of the market while awaiting the appraisal and inspection results,

When buying a property with high demand, a considerable deposit can compel the seller to select your offer over others. You may also get more favorable contract terms.

Parties in a home sale can agree to apply earnest money to the buyer’s down payment or closing costs. In such a case, you’re putting up some amount for the home in advance.

How much earnest money should a homebuyer pay?

The amount of earnest money you offer varies based on the market and the condition of the house. If you want a home in a location prone to bidding wars and cash offers, you may have to offer a considerable amount. A lower earnest money deposit may be suitable for a fixer-upper in a slow market.

In most real estate markets, the average good faith deposit is between 1% and 3% of the property’s purchase price. It can be as high as 10% for highly competitive homes with multiple interested buyers. Some sellers prefer to set fixed amounts to help filter out buyers that aren’t serious.

The best way to determine a reasonable earnest money amount is to talk to an experienced real estate agent. They’ll assess the property and market-specific factors and quote a figure within the standard range. While losing your good faith deposit is unlikely, offer an amount that the seller will appreciate without exposing yourself to financial risk.

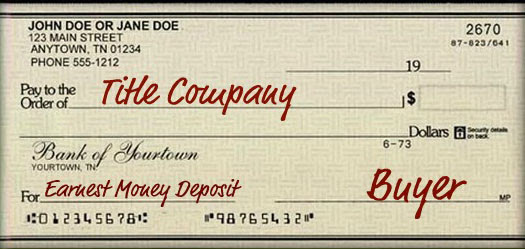

Paying earnest money deposit

Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer.

The funds remain in the trust or escrow account until closing. That’s when they get applied to the buyer’s down payment or closing costs. Alternatively, you can receive your earnest money back after closing.

Is earnest money refundable?

Contrary to popular belief, homebuyers don’t always forfeit their earnest money to the seller if a deal fails. The buyer gets their good faith deposit back if r the seller terminates the home sale without a valid reason.

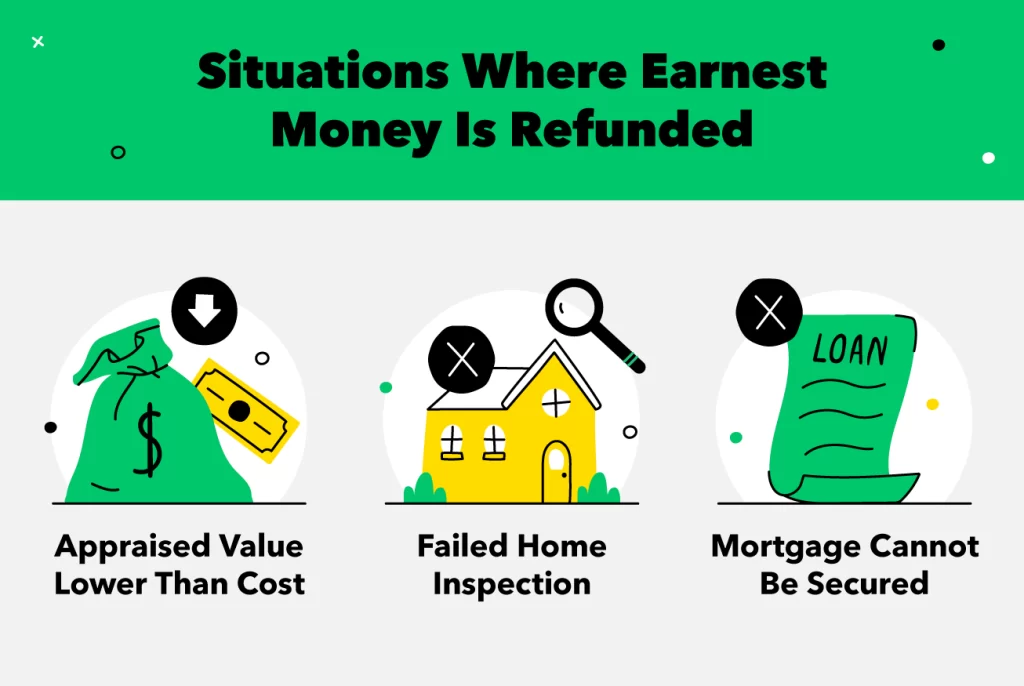

You may also reclaim your money if the reason for contract cancellation is a contingency outlined in your purchase contract. Examples of known real estate deal breakers include:

- When a home inspection reveals severe housing defects

- If the appraisal amount is lower than the home sale price and the seller will not re-negotiate the sales price

- When the homebuyer can’t secure financing

- When a buyer is unable to sell their current home before closing on the new one

It’s important to understand potential contract contingencies, so be sure to go over the contract with your real estate agent or attorney.

When do you lose earnest money?

There are times when homebuyers lose their earnest money after a broken deal. Two scenarios that may lead to the forfeiture of your good faith deposit are:

- Waiving your contingencies. Financing and inspection contingencies protect your earnest money if your mortgage doesn’t go through or the house is beyond repair. However, if you waive either contingency, you forfeit your good faith deposit if the house does not go to sale.

- Ignoring contract timelines. Home purchase contracts often have timelines within which the buyer should complete the purchase process. Failure to close the transaction on the agreed date means you have breached the contract. You may have to forfeit your good faith deposit.

What if I change my mind?

Property buyers get their earnest money back if the deal goes south for reasons covered in contingencies. Otherwise, there’s little or no chance of a refund.

If you change your mind late in the buying process for reasons other than contingencies, the seller can keep the earnest deposit. It compensates them for the time, money and effort required to list the property again and obtain another buyer.

How to protect your earnest money deposit

Take the following measures to protect your earnest money from fraud or unjustifiable forfeiture:

- Put everything in writing. Make sure your contract clearly defines what amounts to canceling the sale and who ends up with the earnest money. Include any amendments to details like buyer responsibilities and timelines.

- Use an escrow account. To avoid trust issues, never hand your earnest money directly to the real estate seller or broker. Let the manager be a reputable third-party, such as an escrow company, legal firm, title company or a renowned brokerage firm. Make sure the funds are in an escrow account and obtain a receipt.

- Understand the contingencies. Ensure that contingencies that protect your interests are in the contract. Most importantly, you shouldn’t sign a home purchase agreement that doesn’t have the clauses that protect you.

- Meet your responsibilities. Real estate purchase agreements usually set deadlines to protect sellers. Be sure to respond to all questions and provide requested documents in a timely manner, as well as meet inspection, appraisal and closing deadlines to avoid breaching the contract.

Buying a home is a big purchase. You want to make the best offer and protect yourself in the process. Earnest money allows you to communicate your seriousness and ensure your seller is committed. If you’re a first-time homebuyer, speak to a Home Lending Advisor to learn more about ins and outs of earnest money.